Finding the best auto insurance for young drivers isn’t always a walk in the park. It’s not for lack of options. It’s just the opposite; it's easy to feel overwhelmed. But don't worry; we've researched it for you. The insurance market for young drivers tends to be expensive due to the higher risk associated with less driving experience. Even in the UK, drivers aged 17 to 20 often face premiums exceeding £2,000 per year.

However, there are ways to reduce costs, such as black box insurance, which tracks driving habits and rewards safe driving.

In the United States, insurers like Progressive, Geico, Auto-Owners, State Farm, and Nationwide offer competitive rates and discounts for young drivers. The national average for full coverage ranges from $5,464 per year for 20-year-olds to $3,320 for 25-year-olds. This article explores the best auto insurance options for young drivers in 2025, focusing on affordability, coverage, and customer satisfaction.

See also:

Top Reasons to Buy a Used Nissan Kicks

Why Auto Insurance For Young Drivers Is Essential

Photo Credit: Pixabay.

More than a legal requirement, auto insurance is a financial safety net. Young drivers, defined as those aged 16–24, are statistically more likely to be involved in accidents, which makes having the right insurance crucial. This age bracket is indeed overrepresented in accident statistics globally.

Data from the FHA’s (Federal Highway Administration) National Household Travel Survey shows that drivers aged 16–19 are 3x more likely to crash than drivers 20+ due to inexperience and risk-taking. Closer to home, an NHTSA (National Highway Traffic Safety Administration) survey found that teens (16–19) account for 8.5% of fatal crashes, with just 5.1% having a driver’s license.

Furthermore, 16-year-olds have demonstrated a crash risk rate 1.5x higher vs. 18–19-year-olds. According to the IIHS (Insurance Institute for Highway Safety), the fatality rate per mile driven is 4x higher for teens than adults (20+). These statistics and alarming survey data underscore the importance of seeking out the right coverage to protect you from financial ruin in case of an accident. Both the young and their families deserve peace of mind.

Key Factors to Consider

Here are the five key factors to consider when choosing the best auto insurance for young drivers:

Coverage Options and Limits

- Ensure policies include liability, collision, and comprehensive coverage (essential for high-risk drivers).

- Check if uninsured/underinsured motorist coverage is included (critical in accident-prone scenarios).

Cost and Discounts

- Compare premiums, but don't sacrifice coverage for cheap rates.

- Look for discounts (good student, safe driver, telematics-based, multi-policy, or defensive driving course completion).

Insurer’s Reputation and Claims Process

- Research the insurer’s financial stability (AM Best/J.D. Power ratings).

- Check reviews on claims handling speed and customer service (young drivers may need frequent support). A company with good customer service can make a huge difference when you need to file a claim.

Telematics and Usage-Based Programs

- Opt for insurers offering black box or app-based tracking (e.g., Progressive Snapshot, State Farm Drive Safe & Save).

- These can lower premiums by 15–30% for safe driving habits.

Deductibles and Flexibility

- Choose a deductible the driver can afford in case of a claim.

- Verify if the insurer allows policy adjustments (e.g., adding/removing drivers, changing vehicles).

Bonus Tip: If the young driver uses a family car, bundling them under a parent’s policy is often cheaper than a standalone plan.

Top 10 Auto Insurance Companies For Young Drivers In 2025

Root Insurance

- Why? Uses telematics-based pricing (fairer rates for safe young drivers).

- Perk: Up to 30% discount for low-risk driving (app tracks habits).

Root Insurance is a smart choice for young drivers in 2025—if they're safe drivers. Its telematics-based pricing (via smartphone tracking) rewards low-risk habits with discounts of up to 30%, making it cheaper than traditional insurers for cautious drivers.

However, rates can spike for those with speeding/hard-braking incidents. 2025 user reviews praise its transparency but note claims processing lags behind giants like State Farm. Best for tech-savvy, low-mileage young drivers willing to trade privacy for savings.

Metromile (Best For Low-Mileage Drivers)

- Why? The pay-per-mile model saves money if the young driver rarely uses the car.

- Perk: Base rates + ~6¢/mile, ideal for college students or part-time drivers.

Metromile is ideal for young drivers who rarely use their cars—saving significantly vs. traditional insurers. Its pay-per-mile model (base rate + ~5¢/mile) benefits low-mileage drivers (e.g., students or urbanites). However, 2025 user reviews note GPS tracking glitches and limited service in 8 states.

For infrequent drivers, it’s 30% cheaper than flat-rate policies, but aggressive or high-mileage young drivers may find better deals elsewhere.

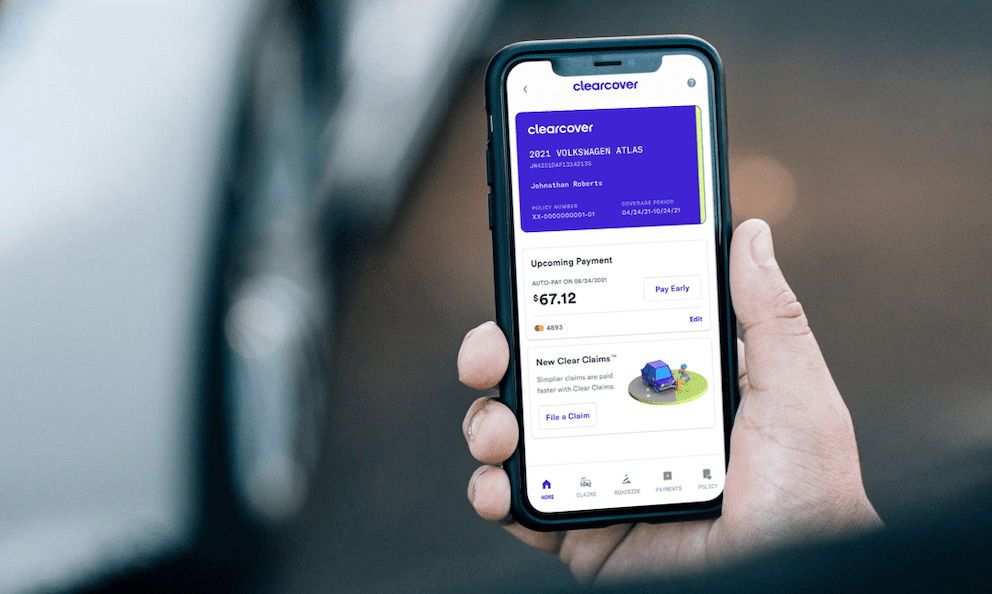

Clearcover (Tech-Savvy And Affordable)

- Why? AI-driven claims and cheaper premiums (up to 20% less than competitors).

- Perk: Easy app management for digital-native young drivers.

Clearcover is a top contender for tech-savvy young drivers in 2025. It offers AI-powered pricing that often undercuts competitors by 15-20%. Its fully digital platform streamlines claims and policy management—ideal for millennials/Gen Z.

However, 2025 user reviews cite slower claims processing during peak periods compared to giants like Progressive. Best for low-risk young drivers prioritizing affordability and digital convenience over agent support. Available in 22 states (expanding).

Erie Insurance (Regional Gem)

- Why? Available in 12 states and offers "Rate Lock" (no hikes for minor claims).

- Perk: New driver discounts and accident forgiveness.

Erie Insurance excels for young drivers in its 12-state coverage area, offering unique perks like "Rate Lock" (no premium hikes for first at-fault accidents) and generous discounts for good students (up to 20%). 2025 J.D. Power ratings praise its claims satisfaction, though its regional limitation and slightly higher base rates than telematics insurers like Root may deter some. Ideal for families prioritizing long-term stability over flashy tech features.

Plymouth Rock Assurance

- Why? "Savings Pass" rewards safe driving with annual refunds.

- Perk: Strong young driver programs in Northeast/Mid-Atlantic states.

Plymouth Rock Assurance shines for young drivers in the Northeast/Mid-Atlantic with its innovative "Savings Pass" program, rewarding claim-free years with annual cash-back bonuses (up to 15%). 2025 data shows competitive rates for drivers under 25—often 10-20% below regional competitors.

However, its limited 6-state availability and lack of telematics options may deter tech-inclined youth. It is best for safety-conscious young drivers seeking long-term loyalty rewards over short-term tech perks.

See also:

Why Drivers Face More Difficulty Driving at Night After the Time Change

State Farm

State Farm is a strong choice for young drivers in 2025. It ranked #1 in J.D. Power’s 2024 U.S. Auto Insurance Study for customer satisfaction among millennials. It offers competitive discounts (up to 25% for good grades, 30% via Drive Safe & Save telematics), and its nationwide agent network provides personalized support—key for inexperienced drivers. It offers good student discounts and a Steer Clear safe driver program.

However, premiums remain higher than competitors like Geico for teens, so compare quotes based on driving history and location.

GEICO

GEICO is known for its competitive rates and user-friendly online services. Young drivers can benefit from discounts like the Good Driver and Good Student discounts. GEICO also offers a mobile app that makes managing your policy easy. It remains a top choice for young drivers in 2025 because it offers competitive rates (often 15% lower than State Farm) and robust discounts—including 15% for good grades and 25% for completing driver’s ed.

While its telematics program (DriveEasy) lags behind Root’s tech, 2025 J.D. Power data ranks GEICO #2 in digital experience. However, premiums spike sharply after accidents—better for low-risk youth than those with violations.

Progressive

Progressive offers a variety of tools to help young drivers save money, such as the Name Your Price tool and the Snapshot program, which bases rates on actual driving habits. It is fantastic for young drivers in 2025, particularly for its Snapshot® telematics program, slashing premiums by up to 30% for safe driving habits. J.D. Power’s 2025 U.S. Auto Insurance Study ranks Progressive #1 for digital tools.

However, rates vary widely—drivers with violations may face steep costs. Best for disciplined young drivers willing to leverage usage-based discounts for long-term savings.

Allstate

Allstate offers young drivers strong perks in 2025, including Drivewise® telematics (up to 25% off for safe driving) and accident forgiveness after three claim-free years. However, 2025 J.D. Power data shows its base rates run 15-20% higher than GEICO/Progressive for teens.

Its "Smart Student" discount (B+ grades) helps, but budget-conscious youth may prefer Root or Clearcover. In any case, Allstate is ideal for families valuing comprehensive coverage over pure affordability.

Nationwide

Nationwide is a solid but mixed choice for young drivers in 2025. Its "SmartRide" telematics program offers up to 40% discounts for safe driving—one of the highest in the industry—and its "EasyPay" plan helps budget-conscious youth with monthly payments. However, 2025 J.D. Power data shows its base rates are 10-15% higher than competitors like GEICO for teens.

Nationwide is best for cautious drivers who can maximize savings through behavior-based discounts, though affordability lags behind digital-first insurers.

Bonus Alternative:

Elephant Insurance

- Specializes in high-risk drivers

- Offers post-accident rate protection

Elephant Insurance is a niche but strategic pick for young drivers—especially those with past violations—thanks to its "Accident Forgiveness from Day 1" perk (rare in the market). While its 2025 rates average 12% lower than GEICO for high-risk drivers, its coverage is only available in 10 states. Customer reviews praise its affordability but note slower claims processing. Elephant is great for youth with spotty records who prioritize upfront savings over robust digital tools.

Note: The first five insurers on this list may not be nationwide but often outperform mainstream companies in niche areas (e.g., low-mileage, telematics, or regional stability). Always compare personalized quotes.

Five Insider Tips To Secure Affordable Car Insurance For Young Drivers

Leverage "Low-Mileage" or Usage-Based Policies

Insurers like Metromile or Root offer pay-per-mile or telematics-based plans. If the young driver clocks under 7,500 miles/year, savings can hit 30%.

Add to a Parent’s Policy (But Stay "Hidden")

Listing the young driver as an occasional operator (not primary) on a parent’s policy can cut costs by 50% vs. standalone plans.

Pro tip: Avoid naming them as the primary driver of their own car.

Exploit "Good Student" Loopholes

Some insurers (like Erie) extend discounts for B averages or higher—even for college students or part-time enrollees. Savings: 10–25%.

Opt for Older, Safer Cars

A 2015–2018 Honda Civic or Toyota Corolla costs 40% less to insure than flashy SUVs or new models (per IIHS 2025 data).

Bundle with Renters or Life Insurance

Lesser-known insurers (e.g., Plymouth Rock) offer multi-policy discounts for bundling auto with renters/life insurance—even if the policies are under different names.

Bonus Hack: Ask about "accident waiver" endorsements (e.g., Elephant Insurance)—some insurers forgive the first accident without raising rates.

The Importance Of Comparing Insurance Quotes

Photo Credit: Pixabay.

Comparing insurance quotes is crucial for finding the best auto insurance for young drivers. Quotes can vary significantly between companies, and by comparing them, you can ensure you're getting the best coverage at the most affordable price.

How To Compare Quotes

- Coverage: Ensure that the coverage offered meets your needs.

- Price: Compare the cost of premiums and deductibles.

- Customer Reviews: Look at customer reviews and ratings to gauge the insurer's reputation.

- Discounts: Check for available discounts that you may qualify for.

Tips For Young Drivers

Photo Credit: Chris Benson/Unsplash.

Take a Defensive Driving Course

Completing a defensive driving course can not only make you a safer driver but may also qualify you for insurance discounts.

Drive a Safe Car

Drive a safety-optimized car like a 2020+ Honda Civic (top IIHS safety pick) to slash insurance premiums by 20–30%. Safer cars = lower risk = cheaper rates for young drivers.

Consider Usage-Based Insurance

Some insurers offer usage-based insurance programs that set rates based on your actual driving habits. This can be a cost-effective option for safe, low-mileage drivers.

Final Thoughts On The 2025 Best Auto Insurance For Young Drivers

Finding the best auto insurance for young drivers in 2025 doesn't have to be overwhelming. The best deals balance affordability, safety rewards, and flexibility. Telematics-based insurers like Root or Progressive's Snapshot® offer the biggest savings (up to 30%) for safe habits.

Low-mileage drivers should explore Metromile, while high-risk youth may prefer Elephant Insurance. Always compare quotes, leverage every discount (good student, bundling), and prioritize coverage over price alone. The right insurer can turn inexperience into long-term savings.